Home Prices – Skyrocketing

Based on Rex Nutting's article, "Average U.S. Home Worth 13% More", from http://www.marketwatch.com/, the average U.S. home prices raised 12.95 percent from the fourth quarter of 2004 to the fourth quarter of 2005, and show no evidence of slowdown.

In the competition of average house prices growth, Phoenix won the first place with a ratio of 39.7%, followed by Washington, 23.7%, then Los Angeles, 22.4%, San Jose, 20.8%, and Baltimore, 20.8%.

Although the growths of average house prices were at amazing speeds in some large cities, in some others, these speeds were not so fast. The radio of Detroit is the lowest 2%, followed by Dallas with 3.7%, then Houston at 4.4% and Indianapolis at 4.5 %.

So a question raised in my mind: what caused the home prices in U.S. to grow so fast? The leftward shift of the supply curve? The rightward shift of the demand curve? Both of them? Or the effect of the government?

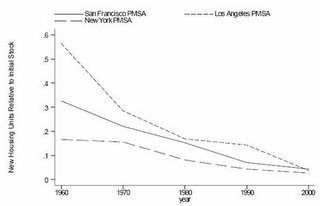

According to a research by Harvard Institute of Economic Research, “Why have the house prices gone up? ”, the key reason to the rise in housing prices is relative to construction costs. Because of the new construction has declined sharply in high price locations, the supply curve shifted to the left.

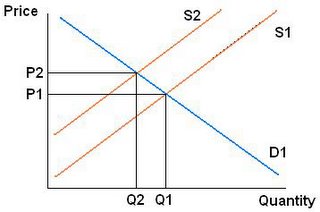

The left picture above is declining construction intensity in select high house value markets San Francisco, Los Angeles, and New York PMSAs, 1960-2000, from the research of HIER, “Why Have The House Prices Gone Up?” The right graft is the possible effect that the declining construction intensity in select high house value markets caused. As less house producers would like to build and supply houses because of the high cost, the supply curve shift to the left. As a result, the prices have gone up.

Of cause, the house market is a really complex market which was affected by all kinds of variables. The analyse I gave about is just a rough one. In the research of HIER, they built a model of house market and use a more accurate way to find the reason. That is beyond what we have learnt right now.

No comments:

Post a Comment